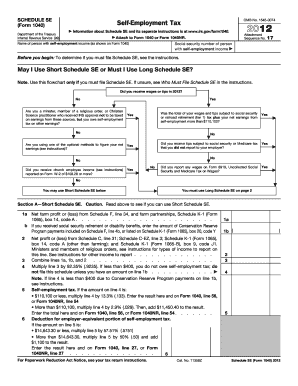

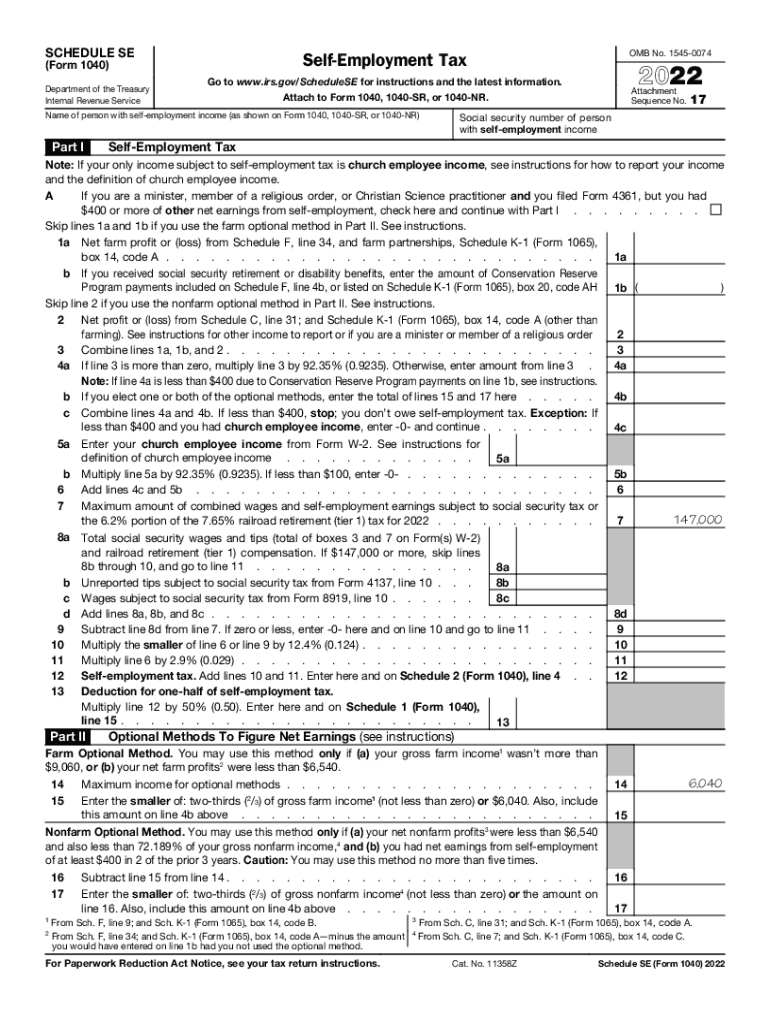

Schedule Se 2024 Form – TaxSlayer provides freelancers with all the necessary IRS forms, plus extensive support from self-employment Schedule C, Profit or Loss from Business. Self-employed workers should use that . The Internal Revenue Service (IRS) has issued a reminder to farmers and fishers who chose not to make estimated tax payments by January that they must generally file their 2023 federal income tax .

Schedule Se 2024 Form

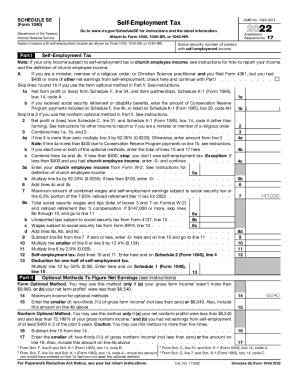

Source : www.abc27.com2023 Form IRS Instruction 1040 Schedule SE Fill Online

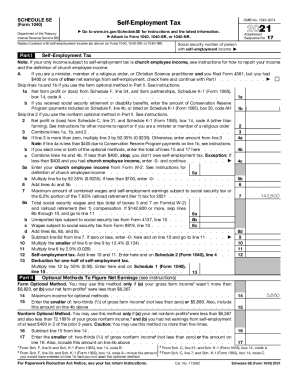

Source : tax-form-1040-instructions.pdffiller.comSelf 2022 2024 Form Fill Out and Sign Printable PDF Template

Source : www.signnow.com2023 1040 schedule se: Fill out & sign online | DocHub

Source : www.dochub.comAbout Schedule SE (Form 1040), Self Employment Tax | Internal

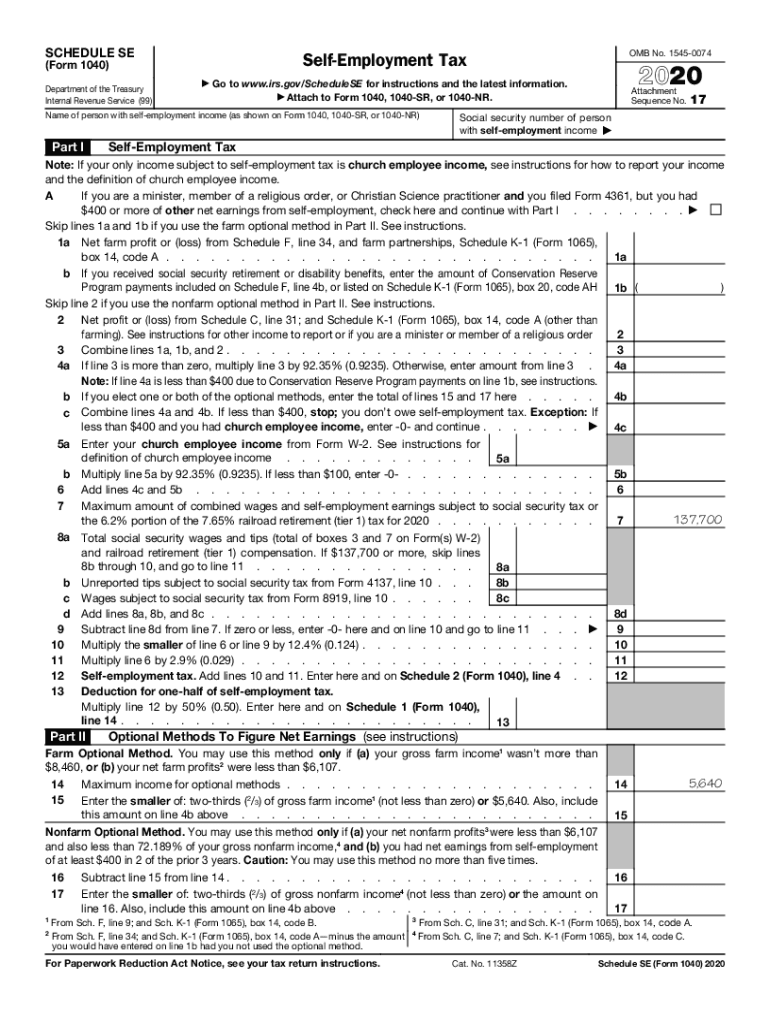

Source : www.irs.govSchedule se 2020: Fill out & sign online | DocHub

Source : www.dochub.comSelf Employment Tax 2020 2024 Form Fill Out and Sign Printable

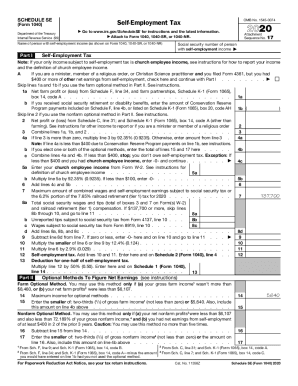

Source : www.signnow.comIRS 1040 Schedule SE 2021 2024 Fill and Sign Printable

Source : www.uslegalforms.comSchedule Se Form Fill Out and Sign Printable PDF Template | signNow

Source : www.signnow.comSelf employed taxes 2022: Fill out & sign online | DocHub

Source : www.dochub.comSchedule Se 2024 Form IRS Releases Updated Schedule SE Tax Form and Instructions for : The standard mileage rate for business miles was 65.5 cents per mile in 2023, and it rose to 67 cents per mile in 2024. Be sure to if your Schedule SE says you owe $2,000 in self-employment . In 2024, the Medicare tax rate is 1.45% The self-employment tax amount is based on net earnings calculated using IRS form Schedule SE. Even though the tax rate is higher when you’re self-employed, .

]]>